Kita

United Kingdom

- London

United Kingdom

- London

- 24/02/2023

- Seed

- $4,797,000

Kita's vision is to be the carbon insurer for the climate crisis, de-risking carbon removal solutions to accelerate their ability to scale.

The climate crisis requires carbon removal solutions to remove carbon from the atmosphere.

Many carbon removal solutions rely on revenue from selling carbon units on the voluntary carbon markets. However, these units lack tailored insurance products for their key risks, particularly under-delivery on forward contracts. This gap contributes to an environment of uncertainty, holding back development, investment and the ability to scale these solutions at speed to achieve necessary climate impact.

Kita removes this “carbon delivery risk” from sellers and buyers in the market, using insurance products that guarantee the quality and delivery of carbon units and carbon removal solutions.

The result?

With Kita removing risk on both sides of the carbon transaction, carbon removal solutions can access greater flows of consistent capital to scale their impact faster.

Kita Earth Limited is an appointed representative of Gateway Platform Services Limited for Insurance Distribution activities. Gateway Platform Service Limited is authorised and regulated by the Financial Conduct Authority (No. 790558). You can check this by visiting the Financial Services Register at www.fca.org.uk/register.

- Industry Insurance

- Website https://www.kita.earth/

- LinkedIn https://www.linkedin.com/company/kitaearth/

Related People

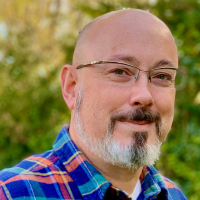

Paul YoungCo Founder

United Kingdom -

London Area

United Kingdom -

London Area

As Chief Technology Officer and co-founder of Kita, I feel privileged and excited to bring all my experience and skills to contribute to the fight against climate change.

Our mission is enabling nature-based solutions to thrive via insurance products that remove carbon delivery risk from buyers and sellers in the voluntary carbon market. Thus enabling more development and accelerating climate impact. And our vision is a world where the value of nature is valued, and the world is free from the existential threat of climate change.

Before founding Kita, I co-founded two successful startups and eventual acquisitions. Twenty-three years of experience leading R&D teams within data science-focused FinTech startups Rare multidisciplinary experience combining entrepreneurship, science, technology and finance.

My early career included implementing and managing machine-learning-based investment strategies managing multi-billion dollar portfolios at one of the world's largest hedge funds, leading to co-founding my first startup, a hedge fund successfully acquired by GLG.

Following five years as Head of Research for Altis Partners, an extremely mathematically sophisticated hedge fund, I became involved in my second startup as Managing Director responsible for establishing a successful B2C wealth management company, Collidr.

These experiences and expertise led me to co-found Sybenetix, a successful FinTech startup Nasdaq acquired in 2017. As part of the acquisition deal, I remained at Nasdaq as Head of Buy-Side Product.

Since then, I have focused my career on Sustainable finance, an area close to my heart where I feel my experiences can have the most impact. Including working on the advisory board of Geospatial Insight designing new sustainable finance data products for ESG investors that use remote sensing and AI to measure greenhouse gas emissions. Also, working as both an advisor, investor, and part-time CTO to Home James, an electric taxi and vehicle services company. Most recently, I was part of Carbon13 Cohort 2, which proved to be both inspirational and energising and where I met my two co-founders at Kita, Tom & Natalia.

Specialities: Startups, FinTech, data science & fund management. Sustainable finance and ESG data products. Data Science leadership. Carbon markets. Fundraising and investor relations.

Integrate | $17,000,000 | (Feb 13, 2026)

Integrate | $17,000,000 | (Feb 13, 2026)

daypass.com | $2,000,000 | (Feb 13, 2026)

daypass.com | $2,000,000 | (Feb 13, 2026)

CYDELPHI | $3,000,000 | (Feb 13, 2026)

CYDELPHI | $3,000,000 | (Feb 13, 2026)

Maestro Tech, Inc. | $1,200,000 | (Feb 13, 2026)

Maestro Tech, Inc. | $1,200,000 | (Feb 13, 2026) Ever | $31,000,000 | (Feb 13, 2026)

Ever | $31,000,000 | (Feb 13, 2026) Manufact (formerly mcp-use) | $6,300,000 | (Feb 13, 2026)

Manufact (formerly mcp-use) | $6,300,000 | (Feb 13, 2026) Santé(US) | $7,600,000 | (Feb 13, 2026)

Santé(US) | $7,600,000 | (Feb 13, 2026) Alva Energy | $33,000,000 | (Feb 13, 2026)

Alva Energy | $33,000,000 | (Feb 13, 2026) Project Omega | $12,000,000 | (Feb 13, 2026)

Project Omega | $12,000,000 | (Feb 13, 2026) Brandlight | $30,000,000 | (Feb 12, 2026)

Brandlight | $30,000,000 | (Feb 12, 2026) Inertia | $450,000,000 | (Feb 12, 2026)

Inertia | $450,000,000 | (Feb 12, 2026)