Adelaide, South Australia - Sherlok, an Australian-based Financial Services company, announced today that it has successfully raised $3.4 million in its latest funding round. The funding was led by prominent investors, including Investible, Rampersand, Common Sense Ventures, and Paloma.

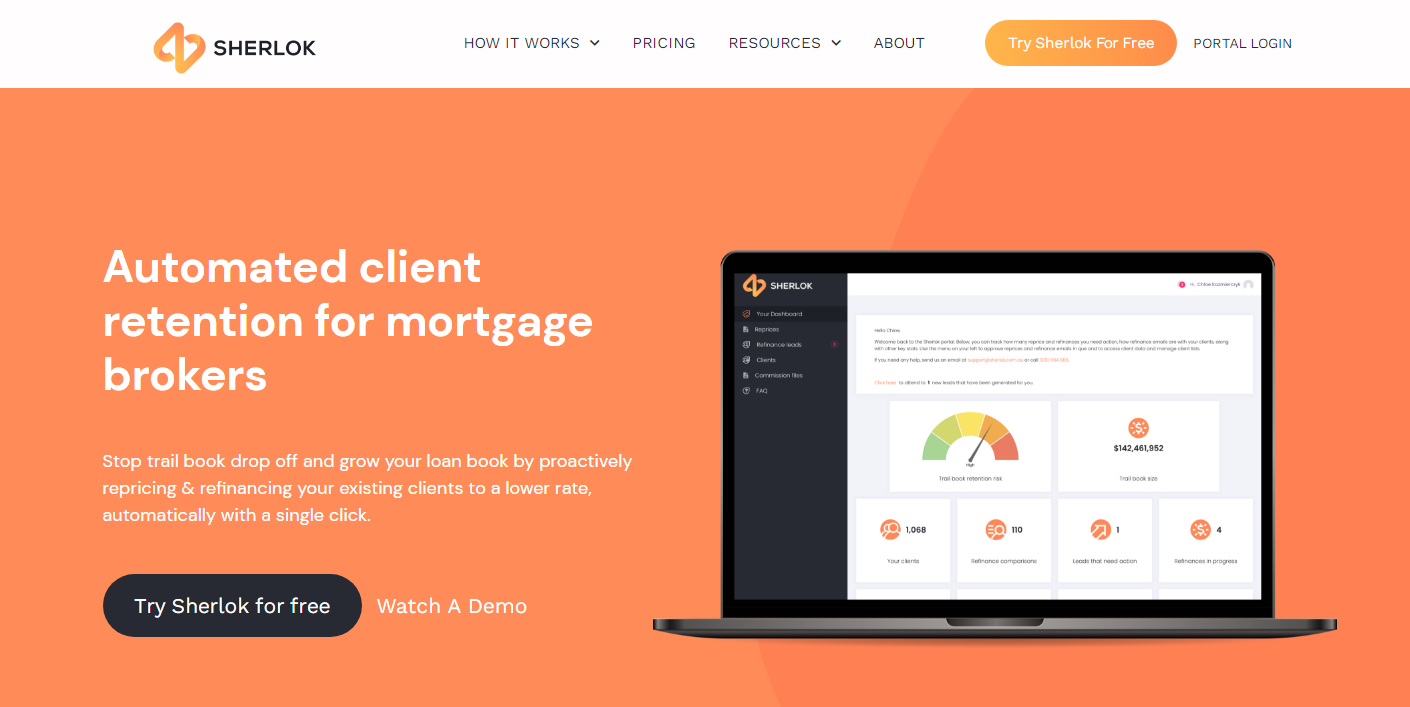

Sherlok, founded by award-winning mortgage broker Adam Grocke, aims to transform the mortgage broker industry by assisting brokers in retaining their clients, protecting their trail book income, and generating valuable refinancing leads. The company's innovative platform provides an automated repricing and home loan refinancing retention tool, revolutionizing the way brokers manage their loan books.

Traditional mortgage brokers face the challenge of banks offering better interest rates to new customers while existing customers are subjected to a "loyalty tax" in the form of higher interest rates. Sherlok addresses this issue by providing a solution that benefits both brokers and their clients.

Sherlok's mission is to empower mortgage brokers to maximize the potential of their trail books. By leveraging the platform's automated features, brokers can enhance their client relationships while simultaneously increasing their revenue. With Sherlok working diligently in the background, brokers become the heroes in their clients' eyes.

Speaking about the funding, Adam Grocke, the founder of Sherlok, expressed his excitement and gratitude. "We are thrilled to have the support of our investors, who share our vision of transforming the mortgage broker industry. This funding will allow us to further develop and expand the Sherlok platform, positioning us as a market-leading solution for brokers seeking to refinance loans."