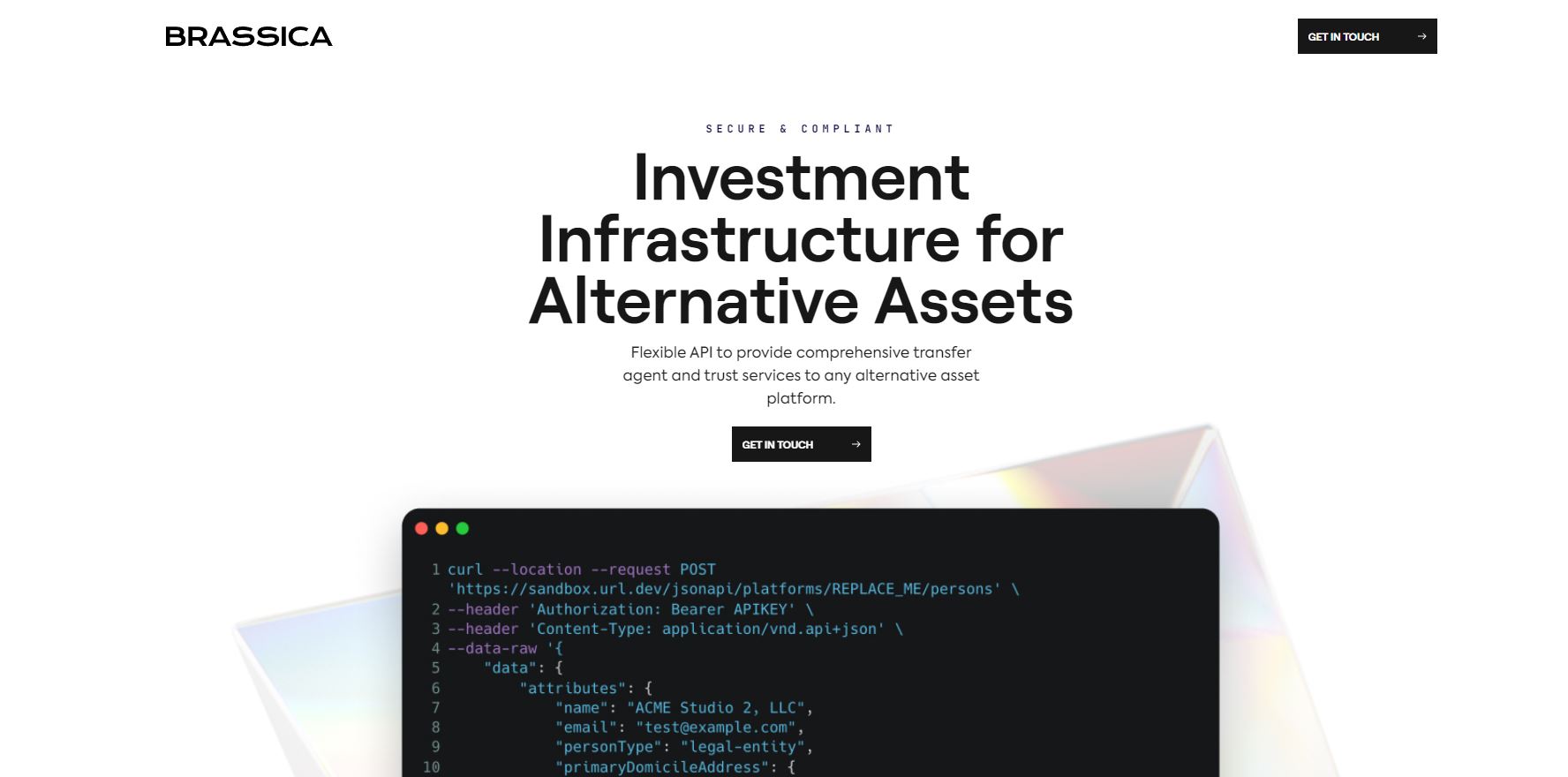

Brassica, the Houston-based financial services startup, has just raised $8 million in seed funding from a group of high-profile investors including Valor Equity Partners, Broadhaven Capital Partners, Mercury(US), Long Journey Venturesas, NEOWIZ, ARMYN Capital, Alpha Asset Management, and VC3 DAO. Founded by Youngro Lee, Brassica is on a mission to create an investment infrastructure for alternative assets that delivers a seamless experience and peace of mind to clients. Their flexible API provides comprehensive transfer agent and trust services that are designed to be seamlessly integrated with existing infrastructure. Whether you're creating securities, holding assets in escrow until contingencies are met, closing offerings, disbursing funds to issuers, or delivering securities to investors' qualified custodian accounts, Brassica has got you covered.

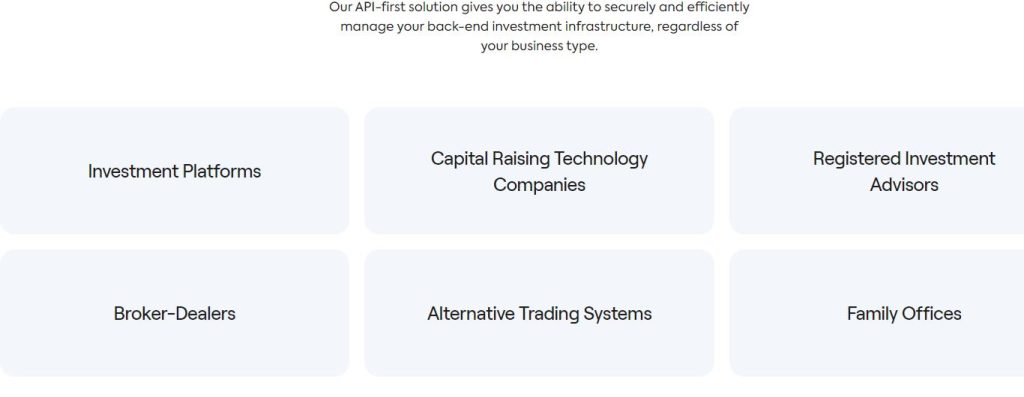

With an SEC-registered transfer agent designed to be programmatically embedded within investment platforms, Brassica offers scalable, cost-effective services for widely held securities issues with thousands of beneficial holders. Plus, their qualified custodian securely and compliantly holds multi-currency fiat, private securities, blockchain assets, and other alternative assets, giving your clients the confidence that their assets are safeguarded by a highly regulated trust company. Discover the future of alternative asset investing with Brassica's API-first technology built with alternative assets in mind.